Just How Underinsured And Without Insurance Motorist Protection Works

Hawaii and Vermont are the most inexpensive states for 25-year-old drivers who want complete coverage. Safe Auto has one of the most expensive insurance coverage for vehicle drivers age 25 among the business in our evaluation. On the early morning of July 4, under a cover of flags and fireworks, Head of state Trump authorized the bill that makes all reported tip income excluded from federal earnings tax, effective for the 2025 tax year. This "no tax obligation on suggestions" measure was a focal point of Head of state Trump's most recent financial plan and has already stimulated lively discussions throughout YouTube, Instagram, and other on the internet platforms. The law is developed to offer instant alleviation to tipped workers, who have encountered climbing living prices and increased analysis of suggestion reporting in the digital age.

Types Of Insurance Protection

Nonetheless, in case of serious injuries, a lawyer may seek an excess judgment if there isn't enough insurance coverage available to cover existing and future medical expenses. This is specifically true if the at-fault celebration has significant properties that might please the judgment. A lot of insurance provider restrict the quantity of time policyholders need to make without insurance motorist and underinsured vehicle driver claims (often it's as couple of as thirty days from the day of the accident). So, you want to get the sphere rolling quickly after you learn that the various other driver has no (or otherwise sufficient) insurance coverage. In numerous states, sufferers can seek a case to obtain settlement from the individual who triggered the accident.

Uninsured driver coverage can additionally be available in handy for advantages like shed salaries and discomfort and suffering, which medical insurance won't spend for. In this scenario, you Click here for more info have coverage for 2 cars under two separate policies, both with $100,000 in UM coverage. If you're hurt when a without insurance chauffeur strikes one of your autos, you would pile UM advantages as much as $200,000.

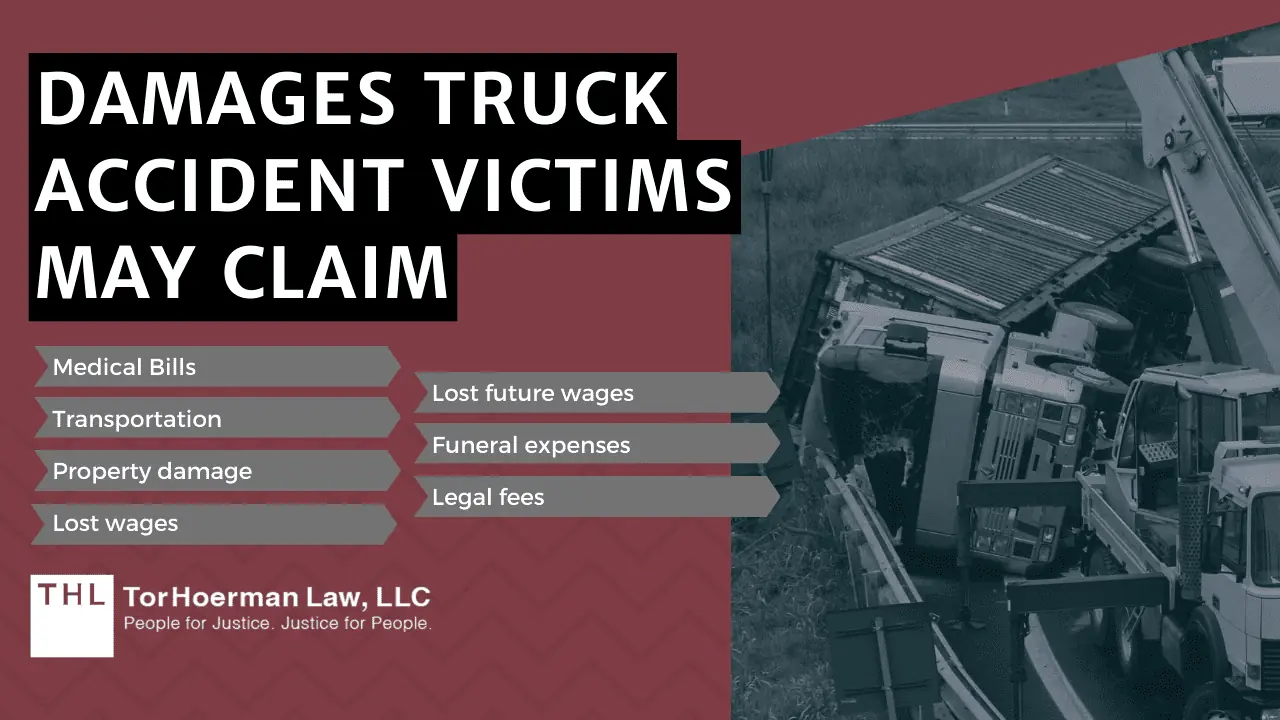

Noneconomic damages for pain and suffering and emotional distress might also be suitable, while those who have shed loved ones can seek an insurance claim for wrongful fatality damages. Accident targets that are instrumental can still seek an insurance claim against a negligent driver as long as the target wasn't 50% or more at fault. Problems will merely be decreased based on their very own percent of fault. If you're facing what occurs if the person at fault in an accident has no insurance coverage, let us assist you browse these distressed waters. This experience is especially valuable when working out negotiations for a no-fault claim, where insurance firms may attempt to lessen payments. These alternate opportunities can offer extra compensation to cover your losses.

Exactly How Commonly Do Car Mishap Settlements Go Beyond The Insurance Policy Restrictions?

Keeping the coverage may be a better economic move due to the fact that it can help in reducing your out-of-pocket costs after a crash or other problem that damages your car. Having appropriate auto insurance policy can assist shield your finances after an accident and many non-accident-related events, but there might be times when going down specific types of insurance coverage makes sense. Establishing whether you should hold on to complete coverage or downsize depends upon several aspects, including the value of your auto, whether you have an automobile finance or lease, your financial resources and even more.

- Uninsured driver coverage does not pay anything to the chauffeur who was without auto insurance policy.Including accident and thorough protection might cost more upfront.Comprehending North Carolina's insurance requirements is essential if you are ever before in a cars and truck accident, particularly when the at-fault chauffeur doesn't have insurance policy.For instance, she might have been "overserved" at a bar before creating the auto accident.It applies if the at-fault chauffeur has insurance policy, yet their restrictions aren't enough to cover your full prices.These can range from a few hundred to several thousand dollars, depending upon the state's regulations and the circumstances of the violation.

If you operate in a dining establishment, bar, resort, salon, or any kind of other tip-based market, your reported pointers up to $25,000 will not count toward your federal gross income. Crash victims can benefit from calling the authorities after any type of crash. Cops can come to the collision scene, perform an examination and gather information about the other chauffeur and witnesses to the accident.

Driving without car insurance coverage can cause big monetary and legal problems if you're in a mishap. If you trigger a crash and don't have insurance coverage, you'll need to spend for the fixing and replacement prices of the other lorry. You'll also have to cover any residential property damage and medical expenditures for those harmed. Accident insurance claims permit targets to seek damages for Lawyer for rear-end car accidents medical bills, shed revenue, discomfort and suffering, and vehicle fixings. Proof such as clinical documents, repair work quotes, and witness declarations strengthens the case, and professional statement might be necessary for showing long-lasting injuries or economic losses. Without insurance and underinsured vehicle driver cases include intricate insurance coverage and lawful language. Do not attempt to go after an uninsured or underinsured vehicle driver case by yourself. In a typical uninsured vehicle driver case, you're not filing a claim against the at-fault driver, since it's most likely they don't have insurance because they do not have much cash.